[ad_1]

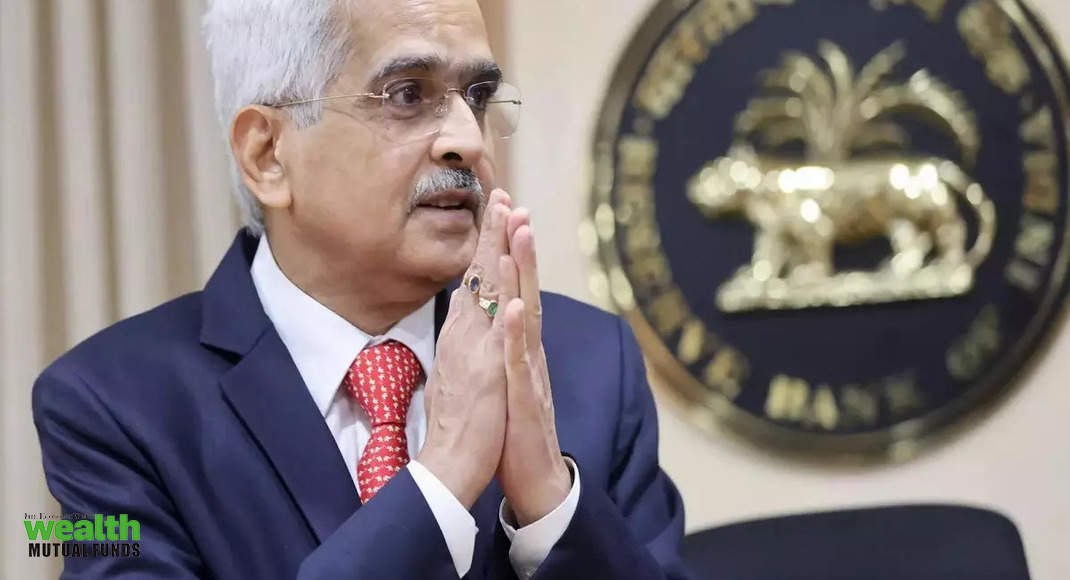

“The Monetary Policy Committee (MPC) met on 28th, 29th and 30th September 2022. Based on an assessment of the macroeconomic situation and its outlook, the MPC decided by a majority of five members out of six to increase the policy repo rate by 50 basis points to 5.9 per cent, with immediate effect. Consequently, the standing deposit facility (SDF) rate stands adjusted to 5.65 per cent; and the marginal standing facility (MSF) rate and the Bank Rate to 6.15 per cent. The MPC also decided by a majority of 5 out of 6 members to remain focused on withdrawal of accommodation to ensure that inflation remains within the target going forward, while supporting growth,” said the RBI Governor in his statement.

“While RBI has hiked rates by 50 bps, the stance still remains at removal of accommodation. RBI has acknowledged that the policy is still accommodative. Rates would have to rise more to reach a neutral situation. Bond markets had already built in the 50 bp hike and are likely to remain range bound. In the medium term, inflation is likely to keep rates high,” says Sandeep Bagla, CEO, Trust Mutual Fund.

The RBI governor said rate hikes by central banks in developed countries and Russia-Ukraine conflict are presenting a challenging scenario. And a likely global recession may keep emerging economies like India under pressure in the coming months.

“The policy was broadly in line with our expectations. RBI addressed all the major issues, including global monetary policy and geo-political issues. Broadly it feels like scope for future rate hikes is open. Our expectation is another 50bps in December and then it can turn data-dependent. On liquidity, RBI seems comfortable with the current situation,” says Pankaj Pathak, Senior Fund Manager, Quantum Mutual Fund.

Mutual fund managers and advisors have been telling investors to be cautious and stick to their investment plans as per their asset allocation. Many advisors have been telling their clients that this is not the time to be adventurous. Equity mutual fund investors should remember that they should not take any aggressive bets at this point and stick to their investment plans. New investors should stick to aggressive hybrid schemes, balanced advantage funds, large cap funds, and flexi cap funds.

Debt mutual fund investors should stick to short term schemes like liquid funds, money market funds, ultra short duration funds, corporate bond funds, floating rate funds, banking & PSU funds, etc. Long term funds and gilt funds are likely to be volatile and may lose money in the as rising interest rates are always negative for these funds.

“From investors point of view, dynamic bond funds remain a very good category, given the uncertainty globally. We don’t know how long the RBI will keep the rate hike cycle. But you have to understand that these funds come with higher volatility and need investors to remain invested for a longer time. Conservative investors should stick to liquid funds because liquid funds have become more rewarding in the last couple of months. Stick to them if you don’t want to take extra risk,” says Pankaj Pathak.

“Yields are likely to rise, impacting long maturity funds in an adverse manner. The shorter end has already most of the rate hikes and should not react much,” says Sandeep Bagla.

[ad_2]

Source link